The pandemic has been a difficult phase for all of us. However, there is a silver lining, we have successfully digitized operations and payments in most sectors around the world. But the fact remains that digital payments in the healthcare business are still a far-fetched goal. 51% of patients still receive their medical expense bills over postal mail when receiving and paying bills online is much more convenient.

Enhancing digital payments for patients can improve the overall patient experience, expedite financial processing, simplify manual procedures, and offer numerous other advantages to your healthcare business.

Continue reading to discover the advantages of digitizing your healthcare payments.

Benefits of Digital Payments for Healthcare Business

The involvement of payments introduces complexity and lengthens the treatment process. Simplifying this process through digitization stands to benefit the healthcare business. The immediate impact of this change in approach highlights the increased efficiency within the system. Let’s explore the advantages linked to the implementation of digital payments in healthcare.

Improves business proficiency

Through automated operations, the need for manual intervention significantly diminishes, virtually eliminating the possibility of human error. The entire payment process becomes more streamlined. By allowing practices to send bills via text or email, the procedure is simplified. Patients can manage everything digitally, from reviewing their bills to making payments.

Eliminating paper-based processes not only relieves staff from time-consuming tasks but also empowers them to focus on delivering outstanding customer service and engaging in beneficial practices, such as evaluating performance metrics, identifying areas for improvement, and more.

Furthermore, through a few simple clicks,healthcare digital payment solutions in healthcare facilitate easy forecasting, customization, and management of inventories, all the while securely storing a substantial amount of data.

Simplifying Record-Keeping in Healthcare Businesses

The healthcare industry involves extensive paperwork on a daily basis. Utilizing healthcare digital payment solutions allows for the creation of digital invoices, their submission to patients, and receipt of online payments, all in a single, straightforward transaction. This approach not only spares both you and the patient from the burdensome task of prolonged billing processes but also eliminates the need for manual tracking of invoiced patients, payment status, and follow-ups for outstanding balances.

With healthcare online payment solutions, billing administrators can effortlessly access patient invoices and manage outstanding bills. This approach facilitates a robust expansion strategy for smaller healthcare institutes and enhances efficiency at each phase of the patient experience.

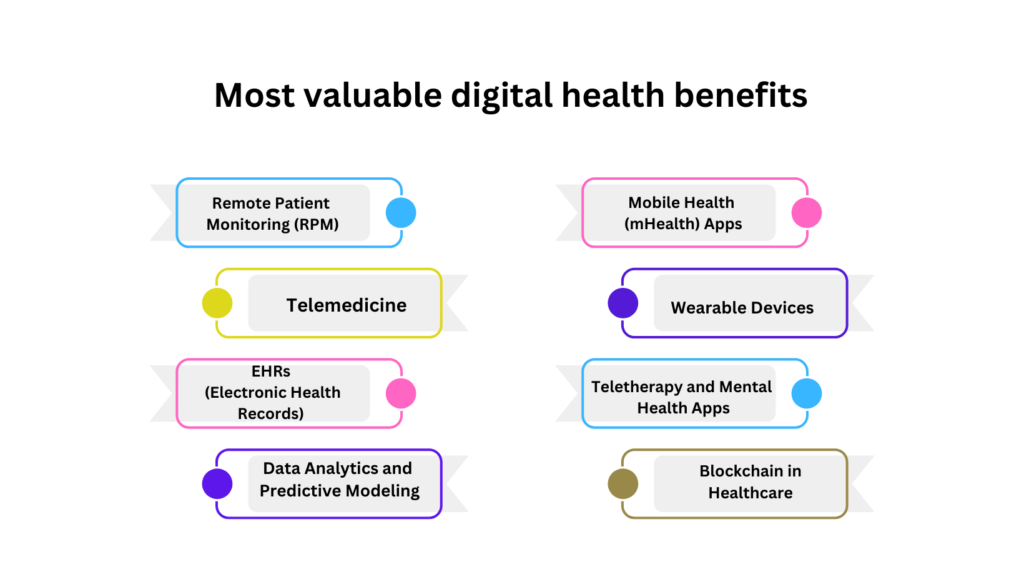

Enables telehealth services

While telemedicine and virtual consultations were already prevalent before the pandemic, there has been a significant surge in the number of platforms since then. The Use of telehealth services has surged nearly 38 times in the wake of the pandemic. Initially, digital payments in healthcare posed a challenge that hindered the advancement of telemedicine. However, these services now enable the remote resolution of patients’ issues, eliminating the need for extensive travel to visit healthcare professionals.

Enhances practice revenue cycle management

Traditional manual payment methods disrupt workflow and contribute to a sluggish process. Presently, the average waiting period for payment in healthcare services is 60 days or more after the patient’s visit. For businesses with growth objectives or those aiming to boost monthly cash flow, these unfavorable accounts receivable (A/R) figures are far from ideal.

In numerous cases, a business can significantly improve its processes by implementing a straightforward method for generating invoices, promptly billing patients, and accepting electronic healthcare payments. Through digitization, the time gap between invoice generation and payment receipt is expected to decrease, as customers will receive their bills promptly, facilitating a simplified payment process.

Timely settlement of claims

Digital portals facilitate timely communication between agencies and policy providers regarding insurance payments, resembling personalized communication received for loan repayments. These platforms maintain comprehensive records, including your name, outstanding debts, and preferred payment method, sending reminders based on this information. Once this data is obtained, settling the debt becomes as straightforward as a simple click of a button.

Just as settlement cycles have shortened, computing and disbursing the required amount have become equally uncomplicated with the use of digital information.

How can digital payments in healthcare improve patient experience?

In the realm of healthcare, the adoption of digital payments creates a mutually beneficial scenario for both the healthcare providers and patients. This dynamic allows patients to readily seek medical attention and access optimal care, while providers can more effectively deliver treatments and ensure the consistent collection of payments.

As observed, there is a growing inclination among patients towards digital healthcare payments over manual alternatives due to its streamlined processes at every stage.

Here are additional methods by which digitizing your healthcare business can revolutionize the patient experience:

Improves communication and engagement

In the digital era, patients seek rapid and convenient access to all their information, encompassing test results and outstanding balances. The integration of digital payments with other healthcare solutions allows patients to effortlessly check in, schedule appointments, and make payments for their visits using their laptops or smartphones.

Compliance with the US Centers for Medicare and Medicaid Services Hospital Price Transparency Rule necessitates the implementation of a digital payment system, emphasizing the importance of improving patient communication and information accessibility. This regulation mandates that hospitals in the United States furnish transparent and easily accessible pricing information for procedures and devices online.

In a survey, 44% of patients affirmed that they expedite the payment of their medical bills when they receive billing reminders through digital means or phone notifications. Utilizing active online portals and digital payment models in healthcare enables providers to accelerate payment collection, fostering improvements in both clinical and financial outcomes.

Creates a transparent ecosystem

A standard medical bill often contains complex information that might be challenging for a layperson to comprehend, potentially confusing the patient or their family. However, with healthcare digital payment systems, every dollar spent is meticulously monitored and verified, virtually eliminating the possibility of financial mismanagement.

A significant level of trust and confidence is fostered when patients can agree with the total amount on the bill and access all information transparently. Any errors or misunderstandings can be promptly rectified and will be instantly reflected in real-time. Consequently, this enhances customer satisfaction and further strengthens trust.

Provides a seamless, modern check-out experience

Consider a scenario where a patient, while waiting for their doctor in the exam room, receives a text message. This message includes an invoice for their co-pay, which they can conveniently pay either during their appointment or shortly thereafter. Such individuals won’t need to spend time at the register for a transaction that can be effortlessly completed from their phones in the waiting area or at home. This modern check-out procedure allows patients to promptly resume their day after their appointment with the healthcare provider.

Furthermore, transitioning all processes to contactless alternatives in a post-pandemic setting not only enhances patient satisfaction but also frees up front desk staff to concentrate on improving the overall patient experience. Instead of processing payments at registers, staff members can dedicate more time to promptly addressing any questions or notes left by patients.

What models can be used from the healthcare digital payment trends?

A significant level of trust and confidence is fostered when patients can agree with the total amount on the bill and access all information transparently. Any errors or misunderstandings can be promptly rectified and will be instantly reflected in real-time.

Real-time payments (RTP)

- Instantaneous Initiation and Settlement: Transactions within the Instantaneous Payments (RTP) system occur almost instantly.

- Immediate Fund Transfer: Funds are transferred immediately upon completion of the transaction.

- Swift Resolution of Transaction Information: All details related to the transaction are promptly resolved.

- Continuous Availability: Real-time payment networks ideally provide 24/7/365 accessibility.

Electronic funds transfer

- Electronic Funds Transfer (EFT): Also known as direct deposit, it involves digitally transferring funds between bank accounts.

- Paperless Process: Conducted entirely in a digital format, EFT eliminates the need for paper documentation.

- Popularity: EFT has become the favored method of money transfer due to its simplicity, accessibility, and direct nature.

- Decrease in Paper Checks: The increasing use of EFT is diminishing the prevalence of traditional paper checks.

Mobile Wallets

- Payment Facilitation: Mobile wallets enable transactions using bank account, debit, or credit card information.

- Secure Storage: Payment details are secure and encrypted stored within the mobile wallet.

- Streamlined Processing: The use of mobile wallets streamlines and expedites payment processing.

- Fraud Reduction: Mobile wallets contribute to reducing fraud in payment transactions.

- Cost-Free: These wallets do not incur any costs for users.

Technologies you can use

- Diverse Technological Options: Numerous technologies are available in the market.

- Flexibility in Choice: Your healthcare business has the freedom to select the technology that best aligns with its needs.

- Tailoring Integration: When integrating digital payments, you can customize the choice of technology to suit your specific requirements and preferences.

How can Digiatto IT services help your healthcare business go digital with your payments?

Digiatto IT services, a prominent healthcare IT consulting firm, stands ready to assist your healthcare business in transitioning to digital payments. As your dedicated partner, we offer end-to-end innovative solutions. Drawing from our extensive experience and diverse clientele, we have developed impactful solutions that can contribute positively to your business success.

As an illustration of its innovative approach, Digiatto IT services successfully pioneered the integration of cryptocurrency for daily transactions during a period when such practices were not widespread. This achievement involved the creation of a mainstream crypto-centric banking solution for Asian Bank. This solution enabled the bank to offer daily banking facilities and conduct transactions using cryptocurrencies like Bitcoin and Ethereum. The digital solution’s implementation led to over 250,000 app downloads and facilitated more than 50,000 cryptocurrency transactions through the Asian Bank platform.

We can assist you in creating top-notch healthcare software. From planning and design to development and implementation, Digiatto IT Services offers comprehensive services. Through thorough market research and creative designs, we can develop a solution that meets both your and your patients’ needs. You can rely on us to provide a safe and secure healthcare digital payment system that’s also fraud-proof.

Explore the potential of digital healthcare payments to enhance your business and boost patient satisfaction. Connect with a service provider such as Digiatto IT Services to develop a fantastic, user-friendly, and trustworthy digital payment solution for healthcare.

FAQs

Q. Why does my healthcare business need digital payments?

To align your business with the evolving preferences of your customers and remain competitive in the growing market of online consultation portals, online pharmacies, and labs, it’s crucial to adapt to digital transformation. Embracing an online portal not only facilitates service delivery but also allows for the digitization of payments, streamlining the financial process for both your healthcare business and your patients.

Q. What technologies can I use to digitize payments?

A diverse range of technologies is at your disposal, such as open bank APIs, EVM codes, mobile wallets, real-time payments, and more. You have the option to develop dedicated online software for healthcare payments, tailored for your patients’ convenience in settling the costs of your services.

Q. What standards under HIPPA require me to use electronic healthcare transactions?

Under HIPAA, compliance is necessary for the following digital transactions:

- Claim status

- Eligibility

- Enrollment and disenrollment

- Referrals and authorizations

- Premium payments

- Coordination of benefits

- Payments and remittance advice.